Factoring company

What is an Invoice Factoring Company?

You may have heard of the concept of factoring, but might wonder, “What is a factoring company?” “What do they actually do?” “Are there different kinds?”

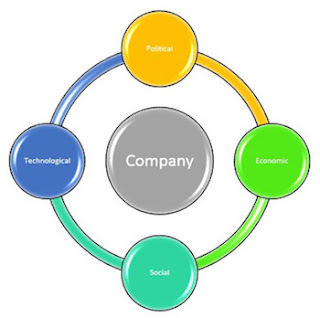

A factoring company is a business that purchases another company’s invoices. Basically, a factoring company offers invoice factoring (or accounts receivable factoring) services to companies of a variety of sizes.

Working with factoring companies is a popular financing solution for businesses that have cash flow issues due to slow-paying customers, seasonal highs and lows or rapid growth.

One important aspect of a factoring company to understand is that businesses don’t borrow any money from a factor. Instead, they are simply advanced their own money ahead of time since it’s their invoice.

Why Would a Business Work With a Factoring Company?

Working with a factor company provides businesses with cash quickly, usually within 24 hours. Because it is so fast and simple, B2B (business-to-business) companies find it to be a great funding solution for unsteady cash flow.

Additional reasons would be that factoring companies approve businesses more easily than a traditional bank loan, there aren’t any long-term contracts, no debt is created and the fees are low.

What Industries Do Factoring Companies Work With?

Companies that provide invoice factoring services typically specialize in a few industries, but we work with the following:

- Construction

- Government

- Healthcare

- Manufacturing

- Oil and Gas

- Service Providers

- Technology

- Telecommunications

- Transportation

- Trucking

- And Others

Benefits of a Factor

The company selling its receivables gets an immediate cash injection, which can help fund its business operations or improve its working capital. Working capital is vital to companies since it represents the difference between the short-term cash inflows versus the short-term bills or financial obligations (such as debt payments). Selling, all or a portion, of its accounts receivables to a factor can help prevent a company, that's cash strapped, from defaulting on its loan payments with a creditor, such as a bank.

Although factoring is a relatively expensive form of financing, it can help a company improve its cash flow. Factors provide a valuable service to companies that operate in industries where it takes a long time to convert receivables to cash—and to companies that are growing rapidly and need cash to take advantage of new business opportunities.

The factoring company also benefits since the factor can purchase uncollected receivables or assets at a discounted price in exchange for providing cash upfront.

0 Comments